net investment income tax 2021 calculator

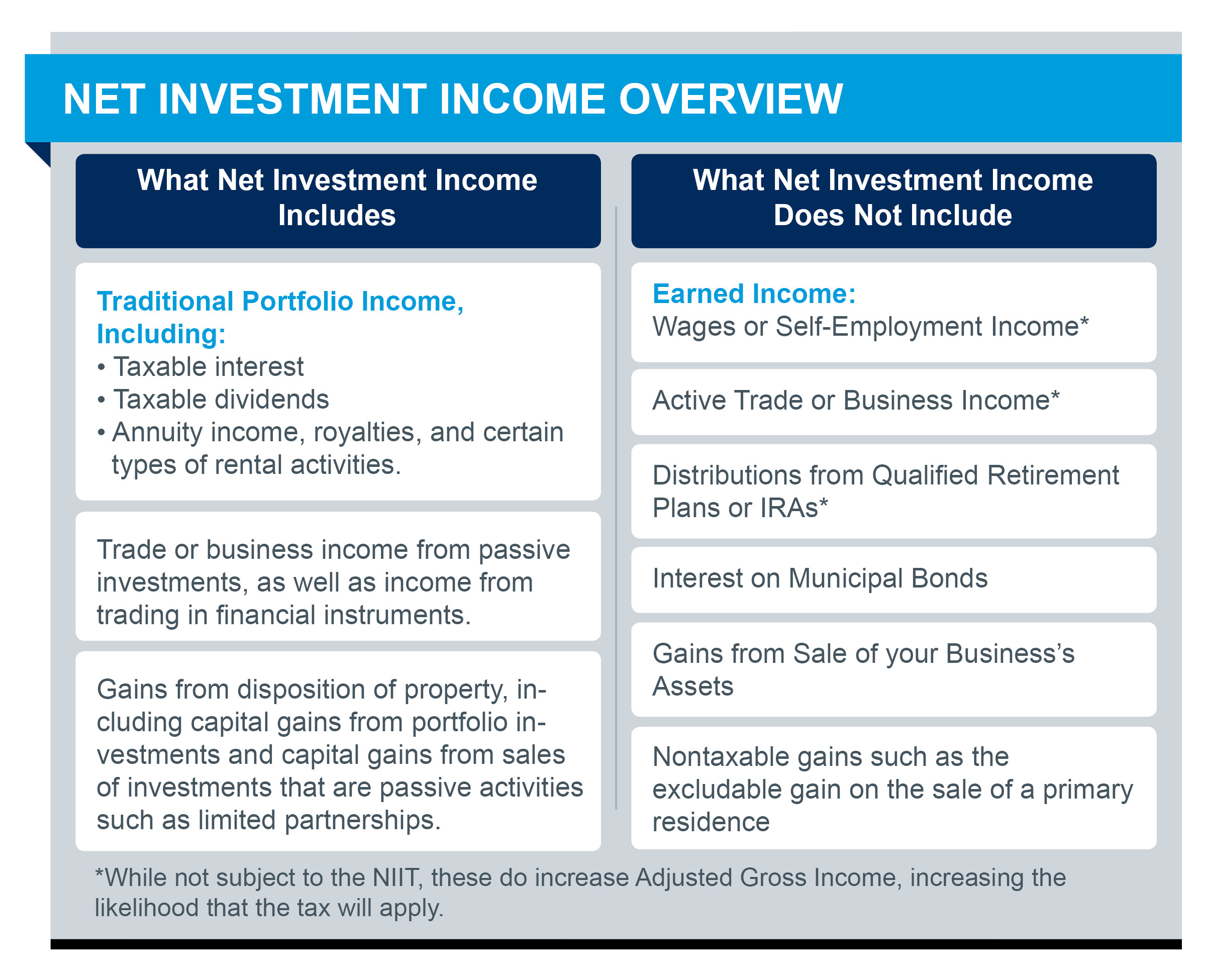

The 38 Net Investment Income NII federal tax applies to individuals estates and trusts with modified adjusted gross income MAGI above applicable threshold. For tax years beginning after Dec.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Net Investment Income Tax Youll be subject to the 38 Medicare tax on net investment income if both of these are true.

. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

We do not calculate the potential tax consequence. As you know the net investment income of individuals estates and trusts is taxed at the rate of 38 provided they have. For tax years beginning on or before Dec.

You have unearned income for 2013 or later years. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. We are only required by the IRS to indicate annuity distributions.

For more information on the Net Investment Income Tax refer to Tax. It is mainly intended for residents of the US. That means you pay the same tax rates you pay on federal income tax.

Theyre taxed like regular income. Your net investment income is less than your MAGI overage. Taxpayers use this form.

20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. Long-term capital gains are gains on assets you hold for more than one year. Income Tax Calculator in India helps determine the tax payable by individuals for the year 2020-21 considers tax rates levied as follows For individuals Hindu undivided families HUFs.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. We earlier published easy NIIT calculator. And is based on.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. Gains from the sale of stocks mutual funds and most other capital assets that you held for more than one year which are considered long-term capital gains are taxed at either a. Calculate Your Net Investment Income Tax Liability The net investment income tax is due on the lesser of your undistributed net investment income or the portion of.

For estates and trusts the 2021. Youll owe the 38. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Maximizing The Investment Interest Deduction

2022 Capital Gains Tax Calculator See What You Ll Owe Smartasset

How Are Capital Gains Taxed Tax Policy Center

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans The White House

Capital Gains Tax What Is It When Do You Pay It

How To Know If You Have To Pay Capital Gains Tax Experian

What Is Capital Gains Tax Experian

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

Federal Income Tax Calculator Atlantic Union Bank

Net Investment Definition Formula Step By Step Calculation

Taxable Income Formula Examples How To Calculate Taxable Income

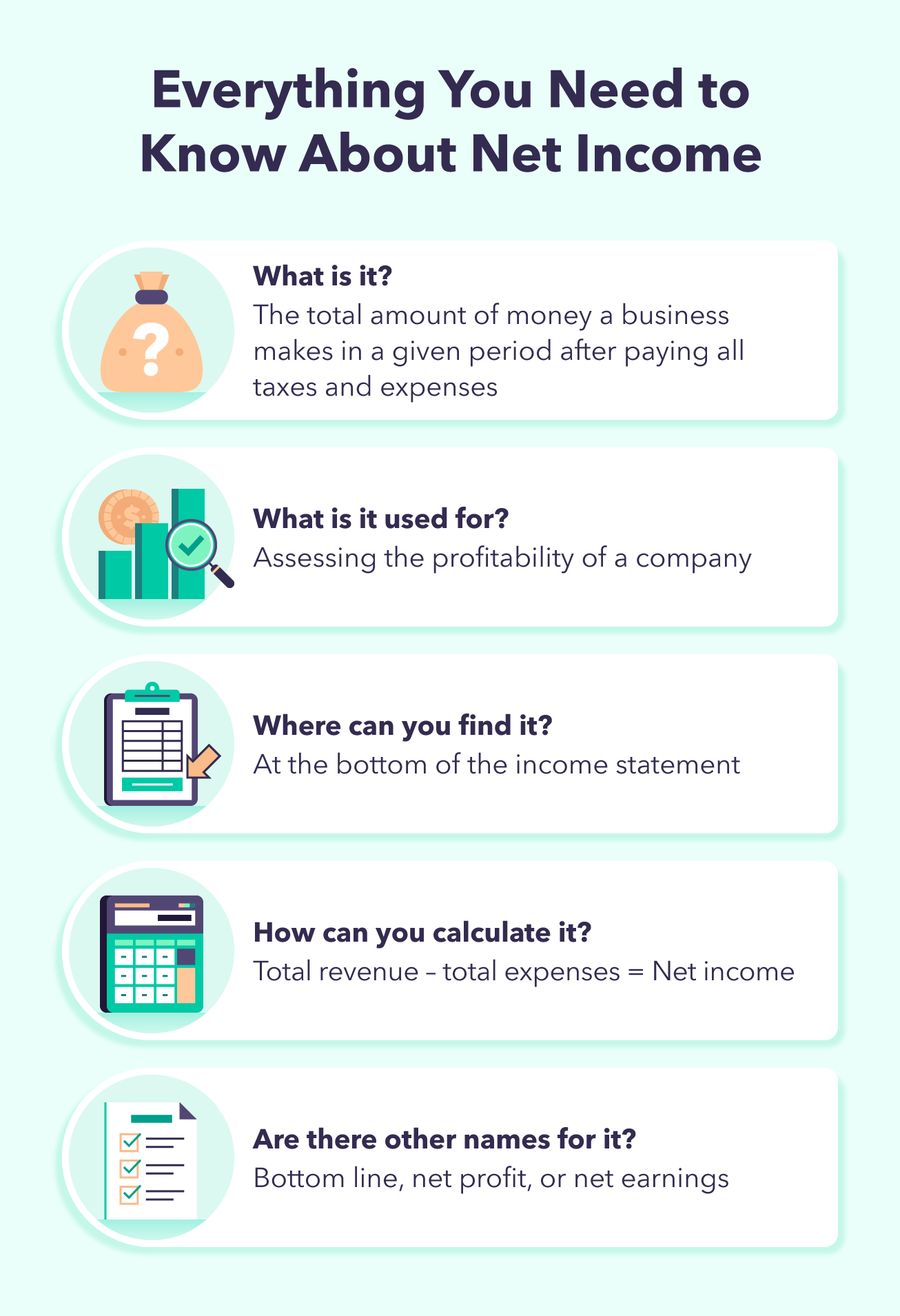

Net Income Formula How To Calculate Net Income Mint

Tax Refund Estimator Calculator For 2021 Return In 2022

Tax Calculator Estimate Your Taxes And Refund For Free

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2014 Net Investment Income Tax Probity Advisors Inc A Member Of Wealth Services Alliance

Tax Calculator Estimate Your Income Tax For 2022 Free

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

Investor Education 2021 Tax Rates Schedules And Contribution Limits